Do you use your car for business and make multiple trips throughout the day? Do you have to keep a log of all your trips? Do you pore over the wads of trip related expense receipts every now and then regretting your most productive time is being used on doing something as mundane as tax or accounting reports?

Let «eCarLog» do all of that for you and reward you with a breath of fresh air, a beam of sunshine and extra time you could invest elsewhere.

«eCarLog»

- Gives you an amazingly simple yet extremely powerful interface to manage your trips. No more misspelled words! No more numbing or finger twisting number entering! We, app authors, are drivers, too, and we know as well as you do how precious is our time when we are in a rush!

- Works seamlessly with kilometers and miles

- Keeps a detailed log of all your trips, trip related expenses and mileage costs either for tax related obligations, claims or deductions or for you personal accounting needs

- Keeps a detailed record of every vehicle you have at your disposal including vehicle make, model, engine displacement, purchase price and mile cost, should that be required

- Keeps a record of driver’s details, such as driver’s name and driver’s license number, when the local legislation requires you to do so

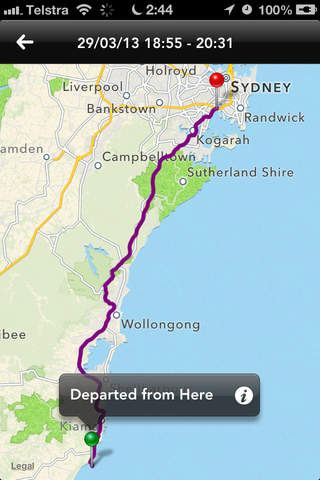

- Utilizes the map to track and show your trip route in real time. While driving, it also allows you to check the GPS service status, see the average trip speed and the total trip time

- Once you have reached your destination, it can accurately adjust mileage (odometer) readings even if you had forgotten to log one or more of your trips a while back. Mileage readings have never been more consistent with the mileage on the clock of your car!

- Keeps a detailed log of all your trips including mileage readings, trip times, trip purpose, trip related expenses, and trip route that you can always review on the map later

- Produces a detailed report for a selected period of time showing accrued mileage (total, business and private), incurred mileage costs (total, business and private) and trip related expenses (total, business and private), as well as business to private mileage ratio for your convenience

- Emails you the log book extract either as an Excel spreadsheet or as a PDF file conveniently named for your report archiving purposes

- Prints the log book extract over the air on any AirPrint compatible printer

If you use «eCarLog» for business purposes, the app purchase cost can also be claimed as a business expense and, as such, is tax deductible where the tax legislation permits so.

Please note, as «eCarLog» makes continued use of GPS in your iPhone, it can dramatically decrease the battery life. Using a charger or plugging your iPhone into a power source is highly recommended, especially when «eCarLog» is used frequently/often.